Constellation Stock #10: Darden Restaurants, Inc. (DRI) - A Strategic Growth Journey

Navigating the competitive full-service dining landscape with strategic acquisitions and robust financial management, Darden Restaurants aims for sustained growth and market leadership in a long run.

Intro

Today, we delve into Darden Restaurants, Inc. (DRI), a leading player in the full-service dining sector. With its diverse brand portfolio and strategic acquisitions, such as the recent addition of Ruth's Chris Steak House, Darden is well-positioned to capture significant market share. At the same time, it is worth mentioning that the company releases quarterly results on the 20th of June, and in the context of consumer demand cautiousness, we expect a spike in the stock’s volatility.

Highlights

Market Position and Competition

Darden holds a substantial market share in the U.S. full-service dining segment, estimated at around 8-10%. Key competitors include Brinker International, Bloomin' Brands, Texas Roadhouse, and The Cheesecake Factory. Darden's competitive edge lies in its diverse brand portfolio and strategic acquisitions, positioning it strongly in both casual and fine dining segments.

Financial Performance

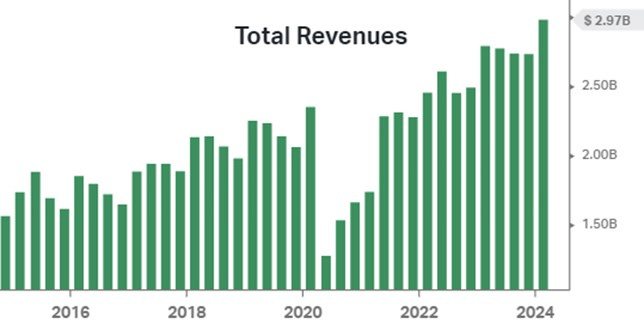

In Q3 FY2024, Darden reported total sales of $3 billion, a 6.8% year-over-year increase driven by acquisitions and new restaurant openings. Despite a 1% decrease in same-restaurant sales, the company achieved an adjusted diluted EPS of $2.62, marking a 12% increase year-over-year, supported by strong performance in December and February.

Management Guidance for 2024

Darden anticipates total sales of approximately $11.4 billion for FY2024, with same-restaurant sales growth expected between 1.5% and 2%. The company plans to open 50-55 new restaurants and projects adjusted diluted EPS of $8.80 to $8.90, highlighting its strategic focus on expansion and operational efficiency.

Challenges and Opportunities

Darden faces challenges from economic pressures, competitive promotions, and integration issues with Ruth's Chris. However, opportunities lie in strong brand equity, operational efficiency, and strategic expansion plans, positioning it to capitalize on market growth and share gains.

Strategic Developments

The acquisition of Ruth's Chris Steak House significantly enhances Darden's presence in the fine dining segment. Planned openings of 50-55 new restaurants and long-term goals for further expansion reflect a strategic focus on growth. Darden's operational excellence and advanced technologies for labor productivity are key drivers for future success.

Company Description

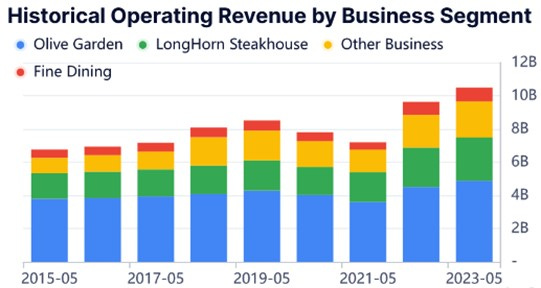

Darden Restaurants, Inc., based in Orlando, Florida, operates a diverse portfolio of full-service restaurants in the U.S. and Canada, including Olive Garden, LongHorn Steakhouse, Cheddar's Scratch Kitchen, Yard House, Ruth's Chris Steak House, The Capital Grille, Seasons 52, Bahama Breeze, Eddie V's Prime Seafood, and The Capital Burger.

In addition to these company-owned restaurants, Darden franchises several of its brands, adding to its extensive reach. The company employs around 190,000 team members and remains committed to culinary innovation, attentive service, and creating engaging dining atmospheres.

Source: GuruFocus

Source: Official website

Market Position and Competition

Market Overview

Darden is a key player in the U.S. full-service restaurant industry, valued at approximately $285 billion in 2023, and projected to grow at a CAGR of 5.3% from 2023 to 2028. The market is driven by increasing consumer spending on dining out and a trend toward higher-quality dining experiences.

Market Potential and Forecast

The U.S. full-service restaurant market is projected to reach around $370 billion by 2028. Darden's diverse portfolio and strong brand recognition position it well to capture a significant share of this growing market. The acquisition of Ruth's Chris Steak House enhances Darden's position in the lucrative fine dining segment.

Competitive Environment

Darden faces competition from national and regional chains, as well as local independent restaurants. Key competitors include:

Brinker International: Owner of Chili’s and Maggiano’s Little Italy, competing with Olive Garden and other Darden brands in the casual dining space.

Bloomin' Brands: Operator of Outback Steakhouse, Carrabba’s Italian Grill, and Bonefish Grill, offering competition in both casual and fine dining segments.

Texas Roadhouse: Competing directly with LongHorn Steakhouse in the casual dining steakhouse segment.

The Cheesecake Factory: A major player in upscale casual dining.

Financial Performance

Revenue

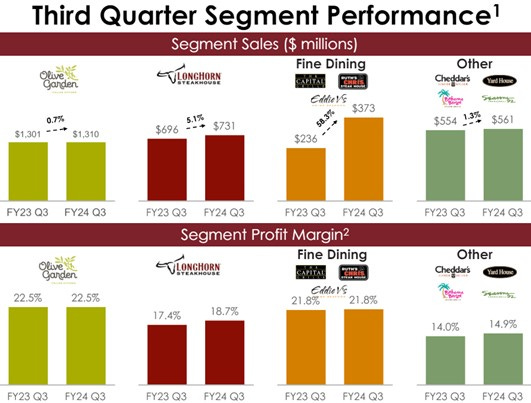

Darden Restaurants, Inc. reported total sales of $3 billion in Q3 2024, marking a 6.8% increase y/y. This growth was primarily driven by the acquisition of 79 company-owned Ruth's Chris Steak House restaurants and 53 other net new restaurants. However, the company experienced a blended same-restaurant sales decrease of 1%.

● Olive Garden: Total sales increased by 0.7% y/y to $1.31 billion, driven by new restaurant growth. Same-restaurant sales decreased by 1.8%, although the segment profit margin remained flat at 22.5%.

● LongHorn Steakhouse: Sales rose by 5.1% y/y to $730.7 million, with same-restaurant sales growth of 2.3%. The segment profit margin improved to 18.7%, up 130 basis points y/y, driven by pricing leverage and labor productivity.

● Fine Dining: This segment saw significant growth due to the addition of Ruth's Chris. Total sales increased to $372.9 million, though same-restaurant sales were negative. The segment profit margin remained stable at 21.8%.

● Other Business: Sales increased slightly to $561 million, driven by Ruth's Chris franchise and managed location revenue. Same-restaurant sales for the brands in this segment were down 2.6%, but still outperformed the industry benchmark by 160 basis points. Segment profit margin improved to 14.9%, up 90 basis points y/y.

Source: Koyfin

Main Expenses

The detailed expense breakdown reveals strategic cost management amidst varying inflation rates:

● Food and Beverage Expenses: Improved by 90 bps, aided by pricing leverage, with total commodities inflation at approximately 1.5%, below the total pricing of about 3.5%.

● Restaurant Labor: Slightly unfavorable by 10 bps, due to total labor inflation of approximately 4.5%, partially mitigated by productivity improvements.

● Restaurant Expenses: Increased by 10 bps due to sales deleverage, offset by robust cost management efforts.

● Marketing Expenses: Increased by 10 bps y/y, aligning with expectations.

● G&A Expenses: Favorable by 40 bps, due to lower incentive compensation and ongoing synergies from the Ruth’s Chris integration.

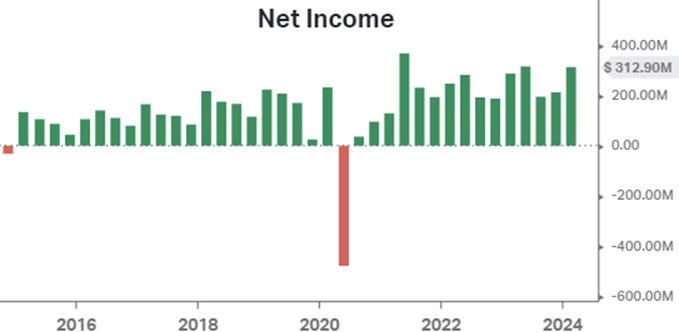

Net Profit

The adjusted diluted EPS from continuing operations for Q3 FY2024 was $2.62, marking a 12% increase y/y. The company's focus on controlling costs and managing business efficiently resulted in significant financial outcomes, despite softer-than-anticipated sales in January due to unfavorable winter weather. The quarter’s strong performance was also supported by notable sales records in December and February across various brands, including Olive Garden’s record Valentine’s Day sales.

Source: Koyfin

In summary, Darden Restaurants, Inc.'s Q3 FY2024 financial performance demonstrated robust revenue growth and effective expense management, leading to a solid increase in net profit despite facing external challenges such as weather impacts and shifts in consumer behavior.

Management Guidance

Revenue FY2024: For fiscal year 2024, Darden Restaurants anticipates total sales of approximately $11.4 billion. This projection includes the contribution from the recent acquisition of Ruth's Chris Steak House. The company expects same-restaurant sales growth to be in the range of 1.5% to 2%. The forecasted revenue is driven by the addition of new restaurants and the expected stabilization of sales trends in the coming quarters. The company plans to open 50 to 55 new restaurants, contributing to the overall sales growth.

Expenses Forecast FY2024:

● Commodities and Inflation: Darden expects total inflation to be around 3%, including commodities inflation of approximately 1.5%. This is a key driver in their pricing strategy, where they plan to price below inflation to maintain a competitive edge.

● Labor Costs: Labor inflation is anticipated to be approximately 4.5%. Despite this, Darden aims to manage these costs through productivity improvements and leveraging technology for better scheduling and labor management.

● Capital Expenditure: Total capital spending for FY2024 is projected to be approximately $600 million. This includes investments in new restaurant openings, ongoing restaurant maintenance, refreshes, and technology upgrades.

EPS: The company has updated its guidance for adjusted diluted net earnings per share from continuing operations to be in the range of $8.80 to $8.90. This excludes approximately $55 million of pre-tax transaction and integration-related costs associated with the acquisition of Ruth's Chris.

Fourth Quarter Specific Forecast:

● Sales: For 4Q2024, the company projects total sales between $2.95 billion and $2.99 billion.

● Same-Restaurant Sales: Expected to range from -0.5% to 1%.

● EPS: Adjusted diluted net earnings per share for the fourth quarter are expected to be between $2.58 and $2.68.

Long-Term Outlook: Looking ahead to fiscal year 2025, Darden plans to open 45 to 50 new restaurants and anticipates capital spending between $250 million and $300 million for these new openings. An additional $300 million in capital spending is projected for ongoing restaurant maintenance, refresh, and technology investments.

Challenges and Opportunities

Headwinds and Risks

Economic Environment: Darden Restaurants, Inc. faces a challenging economic environment characterized by slowing consumer spending, especially among lower-income households. During the fiscal 3Q 2024 earnings call, it was noted that transactions from households with incomes below $75,000 were significantly lower y/y, with the most pronounced impact seen in the Fine Dining segment. This trend is indicative of broader macroeconomic pressures, including inflation and potential recession fears, which could negatively impact discretionary spending.

Weather Impact: Unfavorable winter weather in January 2024 led to a decrease in traffic, impacting same-restaurant sales by approximately 100 basis points for the quarter. Such weather-related disruptions pose a recurrent risk, especially in regions with high weather volatility, affecting both operational efficiency and customer footfall.

Competitive Pressures: The increase in promotional activities by competitors has intensified the battle for market share. Despite Darden’s strategic choice to limit deep discounting and focus on everyday value, the heightened competitive landscape could pressure margins if promotional activities continue to escalate across the industry.

Cost Pressures: Although total commodities inflation was relatively low at approximately 1.5% in 3Q 2024, the restaurant industry continues to face pressures from labor cost inflation, which was around 4.5%. Additionally, construction costs have remained higher than pre-COVID levels, affecting the feasibility and timing of new restaurant openings.

Integration Challenges: The ongoing integration of Ruth's Chris Steakhouse involves significant operational adjustments, including the migration to Darden’s HR platform and distribution network, as well as the transition to a new point-of-sale system. Any delays or issues in this integration process could affect overall efficiency and profitability.

Tailwinds

Market Share Gains: Despite industry-wide traffic declines, Darden has managed to gain market share by outperforming industry benchmarks. For instance, Olive Garden’s same-restaurant sales outperformed the industry by 240 basis points, and LongHorn Steakhouse by 650 basis points in 3Q 2024. This consistent outperformance is driven by strong brand equity and effective execution of the company's operating philosophy.

Brand Strength and Guest Satisfaction: Darden's focus on maintaining high guest satisfaction is paying off. During the quarter, internal metrics showed that all brands remained at or near all-time highs for overall guest satisfaction. High levels of guest satisfaction, especially during peak periods, bolster brand loyalty and repeat visits, providing a buffer against broader economic challenges.

Scale and Data Insights: Leveraging significant scale and extensive data insights has enabled Darden to maintain a competitive edge. The company's rigorous strategic planning and results-oriented culture help in effectively managing costs and optimizing operations. This scale also provides advantages in negotiating better terms with suppliers and implementing efficiency measures across its extensive restaurant network.

Operational Efficiency: Darden’s back-to-basics operating philosophy, focused on food, service, and atmosphere, continues to drive operational excellence. The implementation of advanced technologies for guest count forecasting and AI-driven scheduling has improved labor productivity, while lower turnover rates have reduced training costs and enhanced service quality.

Financial Management: The company has demonstrated strong financial discipline, returning approximately $190 million of capital to shareholders in 3Q 2024 through dividends and share repurchases. The updated fiscal 2024 financial outlook reflects careful cost management and strategic investments, with expected total sales of approximately $11.4 billion and adjusted diluted EPS of $8.80 to $8.90.

Strategic Expansion: The planned opening of 50 to 55 new restaurants in fiscal 2024, coupled with the long-term goal of reaching the higher end of the new restaurant framework, positions Darden for sustained growth. The company’s willingness to walk away from high-cost deals and wait for better terms demonstrates prudent expansion strategies that focus on long-term profitability.

Recognition and Awards: Several Darden brands, including LongHorn, The Capital Grille, and Seasons 52, received the Employer of Choice Award from Black Box Intelligence, reflecting the company's commitment to employee satisfaction and retention. Additionally, Ruth’s Chris was named America’s Favorite Chain Restaurant in Technomic’s annual survey, highlighting the brand's strong market position and consumer preference.

In summary, while Darden faces significant headwinds from economic pressures, competitive activities, and integration challenges, it is well-positioned to capitalize on its operational strengths, brand equity, and strategic financial management to navigate these risks and leverage growth opportunities.

Valuation Considerations

Share Price Performance

Over the last 12 months, Darden Restaurants' stock has underperformed significantly compared to the S&P 500 index. While the S&P 500 showed a steady increase of approximately 25%, Darden Restaurants experienced a decline of around 6%. Darden struggled with reduced dining by lower-income customers and same-store sales declines, despite acquisitions like Ruth's Chris. In contrast, the S&P 500 thrived due to strong tech and growth stock performance.

Source: Koyfin

Stock Price Target Estimate

In attempting to estimate the share price over the one-year horizon, we analyze the company's historical P/E and P/S multiples and set the level most appropriate for the macroeconomic and company-specific factors expected within the year, incorporating consensus forecasts for Revenue and EPS. This methodology allows us to make stock price estimates in a way that is both quick and precise enough to meet our investment horizon criteria.

The financial data suggests that Darden Restaurants has faced challenges but is on a recovery and growth trajectory. If the P/E multiple remains stable at 20.45, the stock price will reflect this growth, leading to an estimated price of $180.7 by the end of FY2024.

Source: constellationstocks.com

Industry Comps Breakdown

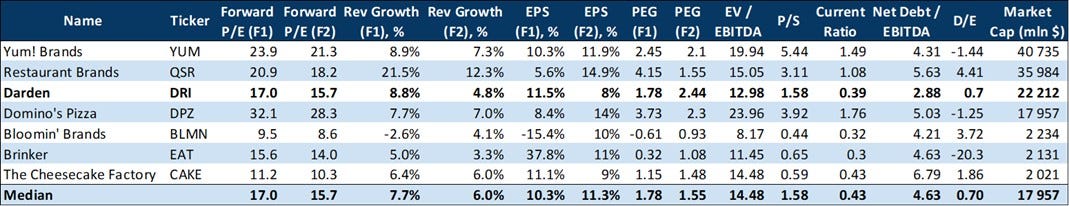

Darden Restaurants appears fairly valued compared to its peers. With a P/E ratio of 17 (TTM), it sits below Yum! Brands (23.79) and Domino's Pizza (32.9), indicating a more attractive valuation. Darden’s earnings growth is competitive, with FY1 at 11.48%, compared to Yum! Brands at 10.25% and Domino's at 8.39%. Its revenue growth of 8.79% is also on par with peers. Additionally, Darden’s gross margin of 19.86% and low net debt/EBITDA ratio of 2.88 highlight strong financial health. Overall, Darden offers a balanced investment with steady growth and robust profitability.

Source: constellationstocks.com

For the comparable multiples analysis, we consider the following companies as DRI's closest peers.

Yum! Brands (YUM) Yum! Brands operates some of the most recognized fast-food chains globally, including KFC, Pizza Hut, and Taco Bell. The company focuses on franchising its brands to drive growth and has a significant international presence.

Restaurant Brands International (QSR) Restaurant Brands International is the parent company of Burger King, Tim Hortons, and Popeyes. Known for its aggressive expansion and franchising model, QSR emphasizes global growth and brand differentiation through innovative menu offerings.

Domino's Pizza (DPZ) Domino's Pizza is a leader in the pizza delivery market, known for its technological innovations and efficient delivery systems. The company leverages its strong digital presence to drive sales and enhance customer experience.

Bloomin' Brands (BLMN) Bloomin' Brands operates casual dining chains including Outback Steakhouse, Carrabba's Italian Grill, Bonefish Grill, and Fleming's Prime Steakhouse & Wine Bar. The company focuses on offering a variety of dining experiences and emphasizes quality food and service.

Brinker International (EAT) Brinker International owns Chili's Grill & Bar and Maggiano's Little Italy. Known for its casual dining atmosphere, Brinker focuses on providing a value-oriented dining experience with a wide range of menu options to attract a diverse customer base.

The Cheesecake Factory (CAKE) The Cheesecake Factory is famous for its extensive menu and premium casual dining experience. The company operates both domestic and international locations and is known for its signature cheesecakes and high-quality food offerings.

Conclusion

Darden Restaurants, Inc. is well-positioned within the full-service restaurant market due to its strong brand portfolio, strategic acquisitions, and robust market strategies. While the company faces competition from other major chains and economic challenges, its focus on operational excellence, digital transformation, and sustainability initiatives will likely support continued growth and market leadership.

Disclaimer

The content of this report is not trading or investment advice and we do not provide any personal investment advice tailored to the needs of any recipient. The information provided should not be considered as specific advice on the merits of any investment decision. Securities trading involves risk, and you might lose your capital and/or incur other damages. Investors should do their own research and consult their registered investment advisor or financial advisor before making any investment decision.

Neither the team nor any of its affiliates accept any liability whatsoever for any direct or indirect loss however arising from any use of the information contained herein. Any unauthorized copy of this research or its contents is illegal.