Carvana's Wild Ride: From $60 Billion to the Brink... And Back?

Carvana's recent share price surge suggests a potential turnaround for the company that once neared bankruptcy. Let's take a closer look to see if it's true.

Hey everyone,

It’s going to be a long read today as we're diving into Carvana's story, a tale that's been nothing short of a rollercoaster. Once valued at $60 billion, the company then teetered on the brink of bankruptcy, and now it's showing signs of an impressive turnaround. Let’s explore how it all started, what went wrong, and where it stands now.

Part I: The Rise

The origins

Carvana was founded in 2012 by Stanford engineering graduate Ernest Garcia III, along with Ryan Keeton and Ben Huston. The company began as a subsidiary of DriveTime, owned by Ernest Garcia II, father of the first founder.

DriveTime Automotive Group Inc. is an American used car retailer and finance company. The company was formerly known as Ugly Duckling, a rental car agency that hit bankruptcy in 1989 and was acquired by Ernest Garcia II to transform it into a used car dealership targeting subprime buyers. After a brief stint as a public company, in ‘02 Garcia had enough of the public life and bought out shareholders in a go private transaction, while rebranding as DriveTime.

With access to a feast of used car inventory, and a hefty helping of financial support from daddy’s DriveTime, Carvana was off to the races, getting big enough that it was eventually spun out in 2014.

Business model

In a nutshell Carvana is a used car dealership calling their ‘car lots’ vending machines. Customers can look online or go to a physical vending machine to pick out a car.

These cars are sourced from auctions, trade-ins, partnered dealerships, individuals – the same as any other used car dealer. Once a car is sold, it’s either delivered to the customer’s doorstep or picked up at one of the futuristic car vending machines across the country. They also offer a seven-day return policy, advertised as a ‘no questions asked’ policy.

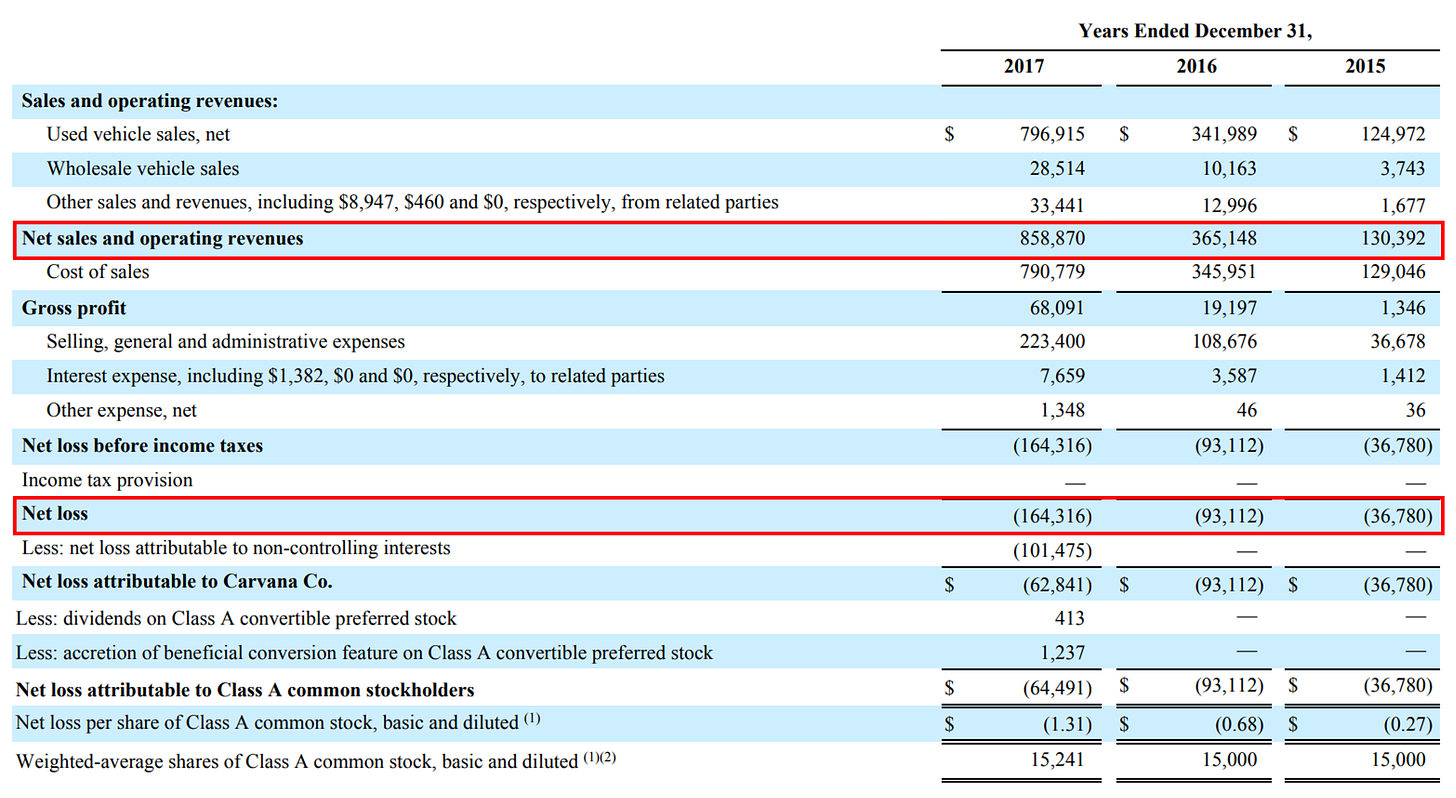

The business model worked, and the company was doubling its revenues every year. However, it still wasn’t profitable.

Source: Carvana’s financial statements for the year ended December 31, 2017.

Going Public

So in 2017, Carvana decided to go public to finance further growth, raising $225 million at a $1.5 billion valuation.

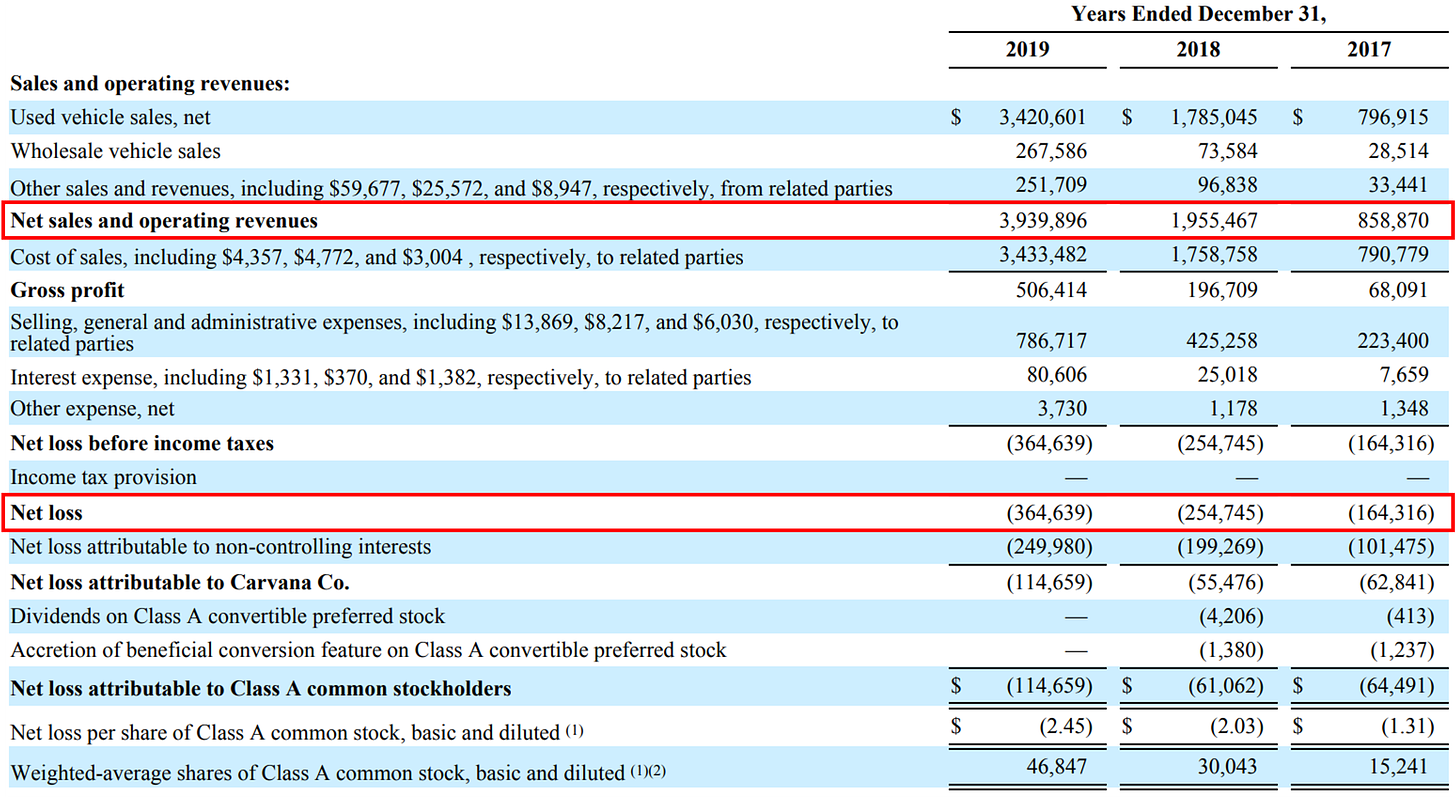

And it actually delivered: revenues continued to double every year after the IPO. However, unit economics didn’t seem to work. But this didn’t bother investors much, with the market cap reaching $5 billion by the end of 2019.

Source: Carvana’s financial statements for the year ended December 31, 2019.

Worth noting, post-IPO, the Garcia family continued to control over 97% of the company’s voting rights. This was due to a dual-class share structure where each share held by the Garcias was essentially like ten shares held by every other shareholder.

Covid

Then Covid came. For Carvana, it was a windfall. Suddenly, buying and selling used cars online became a smart and safe choice.

The pandemic drove millions to ditch public transportation. With stimulus money in their pockets and a shortage of new cars, the demand for used cars skyrocketed.

Carvana also benefited from the tight new-car supply, which drove up the value of used cars. This allowed the company to sell cars at higher prices, pay more for trade-ins, and expand its inventory faster than competitors. When everything shut down between March and June 2020, Carvana was "almost the only place that could actually purchase or sell a car" without human contact, according to independent industry analyst Mel Yu.

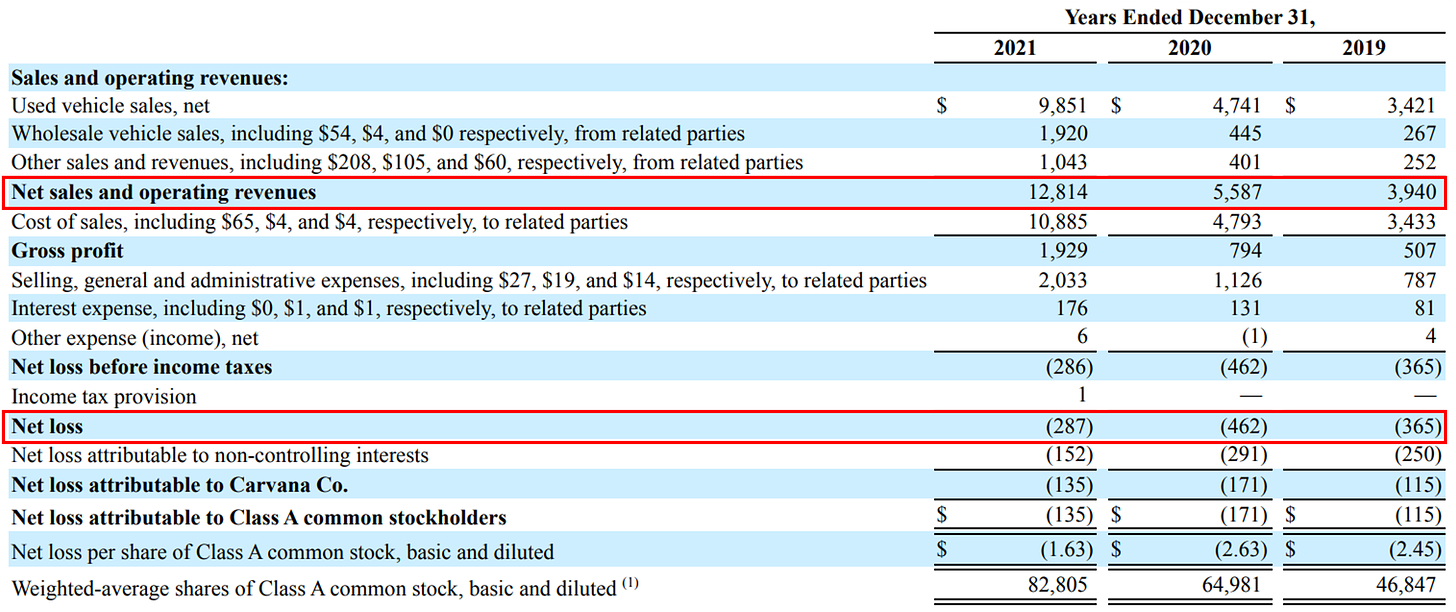

Carvana’s first profitable quarter arrived in the spring of 2021. By August, Carvana’s stock had soared to over $370 a share. With more than 425,000 sales in 2021, Carvana ranked No. 2 on the Automotive News list of top 100 used-car dealership groups. At one point, the company’s market value hit $60 billion. For the year, annual gross profit approached $2 billion on sales of $12.8 billion, marking a nearly 143 percent increase over 2020, which itself saw a 57 percent jump from 2019. While bottom line remained negative, the losses had significantly decreased compared to 2020.

Source: Carvana’s financial statements for the year ended December 31, 2021.

Below is how share price performance looked like since IPO to ATH, an impressive 2640% return.

What could go wrong?

Part II: The Fall

"What goes up must come down" aptly describes Carvana's trajectory. From a high of $370 in spring 2021, Carvana’s share price plummeted to a mere $3.72 by December 2022. What happened?

A combination of factors contributed to this dramatic decline, with the underlying issue being that the company never achieved sustainable profitability and just continued to burn cash. And this was further underpinned by changing macro environment. Here’s a closer look at what went wrong:

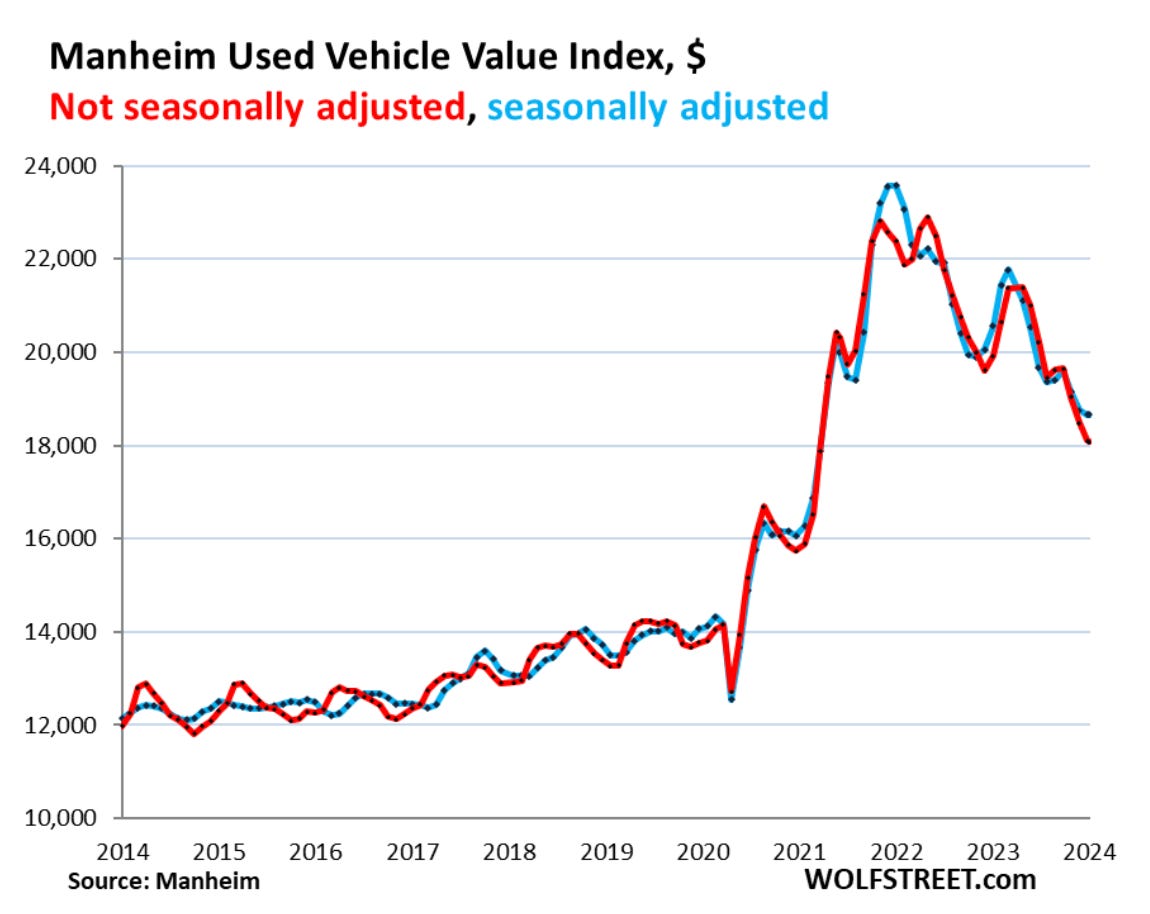

Used-car prices

First, used vehicle prices began to fall starting in spring 2022. By the end of 2022 the down 15% by end of 2022. According to the Manheim Used Vehicle Value Index, by the end of 2022 the prices were down by c.15% and are now down 21.1% from their peak in May 2022. This decline has wiped out over half (55%) of the historic 63% spike from February 2020 through March 2022. This volatility in the used-car market hurt Carvana's ability to maintain high sales margins.

Mounting Debts

Second, starting from 2020 Carvana started to actively raise debt which grew from $0.8bn in 2019 to $6.3bn in 2022. The significant portion of this money was borrowed to fund the $2.2 billion purchase of ADESA, the country's second-biggest wholesale automobile auction house.

Regulatory Issues

Carvana also faced several regulatory challenges. In Raleigh, North Carolina, the company was banned from selling cars until January 2022 due to failure to deliver titles to the DMV and selling vehicles without state inspection. In January 2023, Carvana settled a dispute with Illinois over title transfers, following a near suspension of its retail dealer license. Similar issues arose in Michigan and Pennsylvania in 2022, with temporary prohibitions on handling titling and registration matters.

Revenue Composition

In August 2021, the Wall Street Journal scrutinized Carvana’s revenue recognition practices. It was revealed that about a third of the company’s gross profit per unit came from selling loans made to customers to buy cars. When Carvana makes a car loan, it packages it with other loans and sells the debt to investors, immediately booking gains on the cash sales. While other auto lenders also sell loans to investors, they typically keep the debt on their books, recording gains and losses over time. Critics warned this practice could leave the company vulnerable if debt-market conditions change or if the loans start to sour.

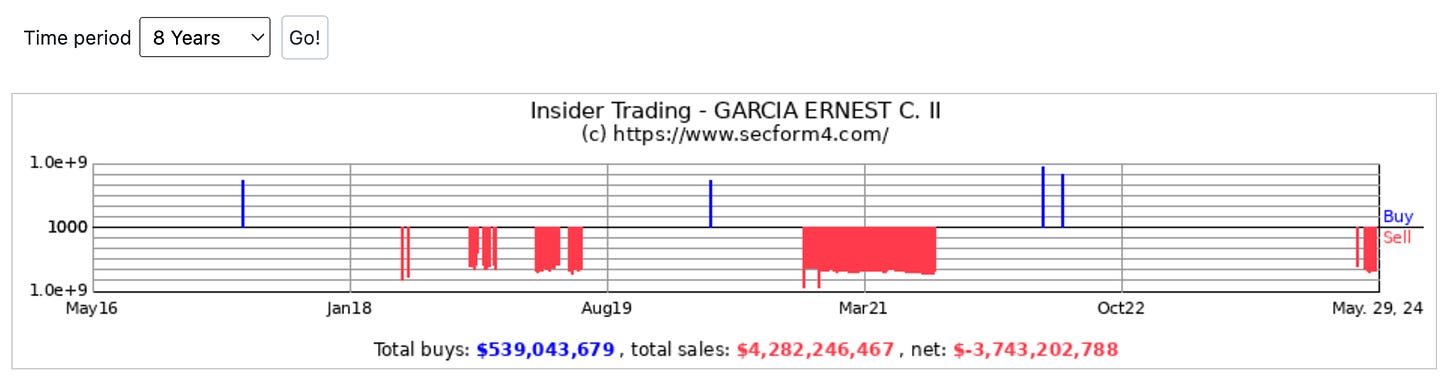

Garcia II’s Stock Sales

Adding to the concerns, in September 2021, the Wall Street Journal reported that Garcia II had sold more than $3.6 billion of Carvana stock, representing 16% of his holdings. This significant sell-off raised eyebrows and cast doubt on the company's future prospects.

Source: SecForm4.com

Rising Interest Rates

Lastly, the era of near-zero interest rates ended. In March 2022, the Federal Reserve raised interest rates for the first time since 2018, starting from 0% by 0.25% to a range of 0.25–0.50%. By July 2023, the Fed had raised rates to 5.25–5.50%, with no cuts since. This increase in borrowing costs put additional pressure on Carvana, which had heavily relied on debt financing.

Part III: The Turnaround

On the brink of bankruptcy, Carvana's controlling shareholders announced major capital and operations restructurings to turn the company around.

Capital Restructuring

On September 1, 2023, Carvana completed a significant Exchange Offer with 96.41% of noteholders agreeing to exchange $5.520 billion of senior unsecured notes due between 2025 and 2030 for new senior secured notes due between 2028 and 2031. As part of the deal, Carvana raised $350 million in equity, with the Garcia family contributing over $100 million. This restructuring lowered cash interest expenses by over $450 million per year for the next two years, reduced combined 2025 and 2027 maturities by 88%, and cut total debt outstanding by more than $1.3 billion.

Operations Restructuring

In the Q4 2022 letter to shareholders, Garcia outlined a three-step restructuring plan aimed at achieving profitability:

Drive the business to break even on an adjusted EBITDA basis

Achieve significant positive unit economics, including positive free cash flow

Return to growth

By Q2 2023, Carvana completed Step 1, removing over $1.1 billion in annualized SG&A expenses from the business since the peak in early 2022. This was primarily achieved through normalized staffing (4,000 layoffs), and optimized inventory and advertising levels.

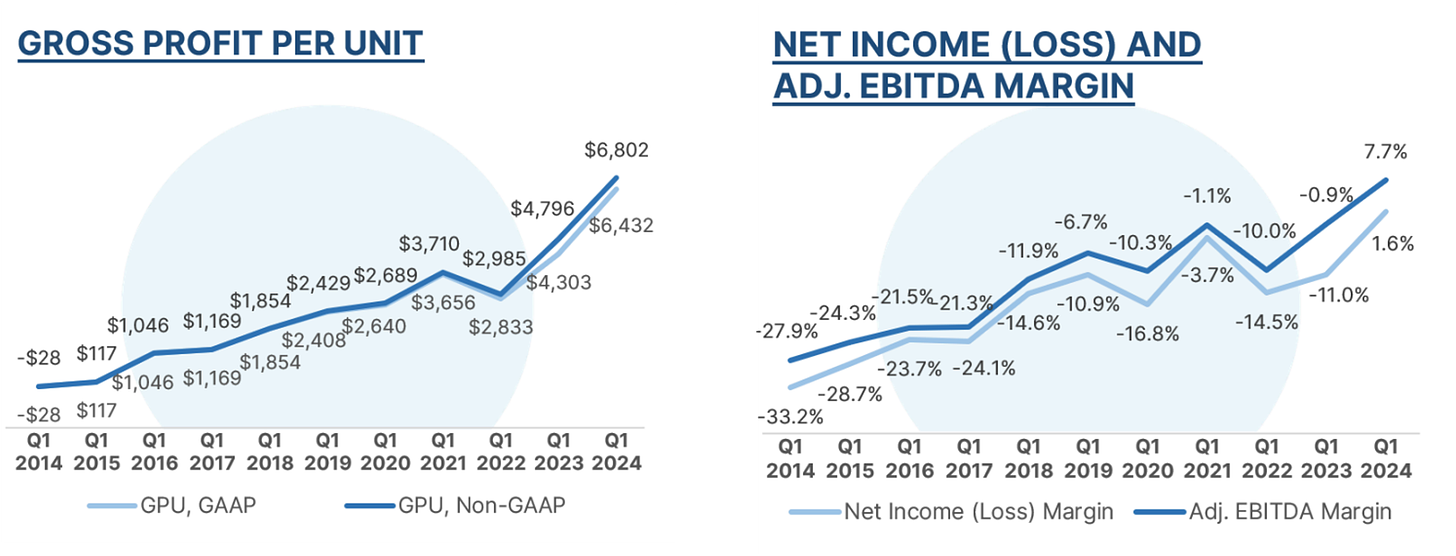

The company made significant strides in unit economics by optimizing retail non-vehicle cost of sales, operations expenses, and advertising costs. Despite streamlined overhead expenses, they remained high due to carrying significant excess capacity. In 2023, total gross profit per unit (GPU) reached $5,511, an increase of $2,489. Carvana sees further opportunities for efficiency gains with ongoing Step 2 initiatives.

Translating into financial results.

Key numbers for 2023:

Retail units sold totaled 312,847, a decrease of 24%

Revenue totaled $10.771 billion, a decrease of 21%

Total gross profit was $1.724 billion, an increase of 38%

Adjusted EBITDA totaled $339 million

Net income for FY 2023 totaled $150 million however $878 million of it came from the gain on debt extinguishment as a result of the corporate debt exchange

In Q1 2024, Carvana continued to improve its operating and financial results:

Retail units sold totaled 91,878, an increase of 16%

Revenue totaled $3.061 billion, an increase of 17%

Total gross profit was $591 million, an increase of 73%

Net income totaled $49 million and included a ~$75 million gain in the fair value of the warrants to acquire Root common stock (this gain did not impact GPU or Adjusted EBITDA)

Adjusted EBITDA totaled $235 million

Carvana emphasized that its current focus remains on increasing efficiency and driving positive free cash flow.

Was the market impressed? Absolutely! From its lowest point in December 2022, Carvana’s share price skyrocketed to $53 by the end of 2023. Based on Q1 2024 results, the company's stock surged by 34%. As of yesterday’s close, the stock marked a staggering 2,722% increase from its lowest levels.

Part IV. What’s Next

Carvana has shown significant progress in operational efficiency and remains focused on further business improvements. Nevertheless, its debt burden remains challenging despite restructuring efforts. Although these measures have provided some relief, the company will likely struggle to meet its financial obligations, with its interest coverage ratio remaining below 1. However, there is optimism that debt holders will recognize the company's efforts and be willing to assist if needed.

Source: Carvana’s Q1 2024 letter to shareholders

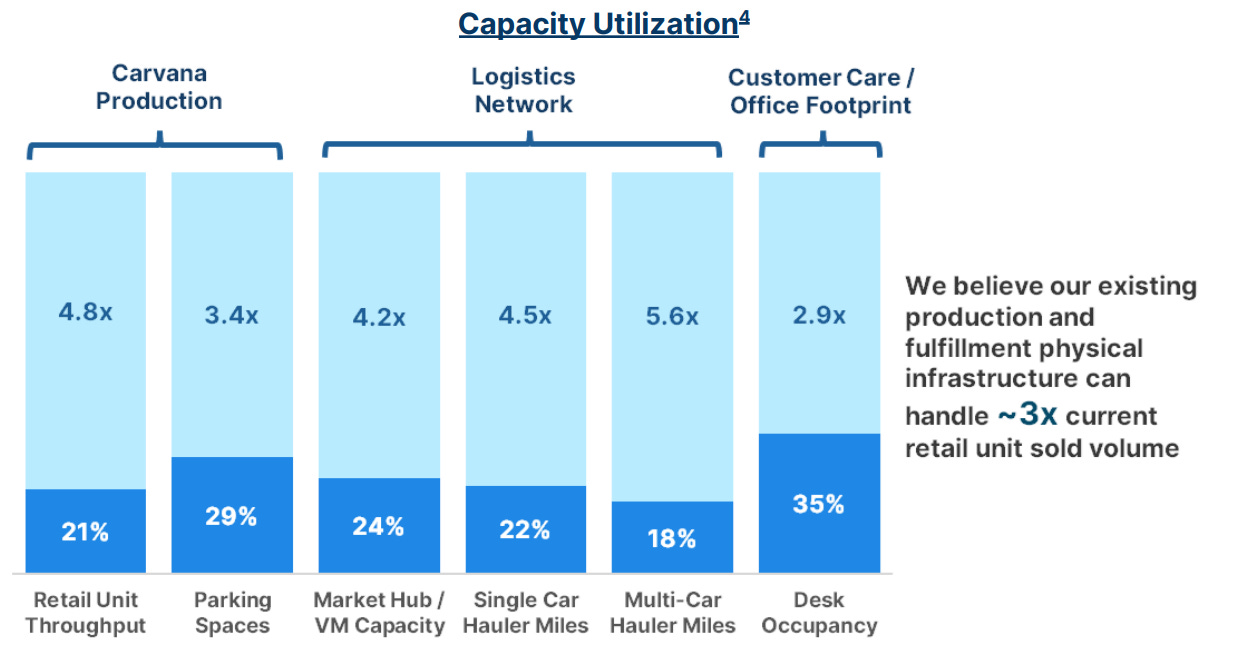

The primary opportunity for Carvana now lies in increasing production by acquiring, inspecting, and reconditioning more vehicles to fully utilize its business capacity. (Considering Carvana's current focus on cost efficiency its inventory remains constrained at the moment).

Source: Carvana’s Q1 2024 letter to shareholders

The market for used vehicles remains substantial. According to Cox Automotive, there were an estimated 35.9 million used vehicle transactions in 2023. This industry is highly fragmented, with tens of thousands of dealers. The largest player holds only about a 2% market share, while the top 100 dealers combined hold roughly 11%.

However, let's not forget that interest rates are still high, making buying cars on credit expensive. Additionally, the continuing decline in used-car prices is pressuring margins.

Part V. Current Valuation

Let’s touch valuation briefly.

Relative to its auto retailing peers, Carvana appears very expensive, with an EV/Sales ratio of 2.7x compared to the average of 0.7x for CarMax, Lithia Motors, AutoNation, and Asbury Automotive Group. This higher valuation may be due to market expectations of significant improvements in Carvana's margins and a return to a robust sales growth trajectory.

Investors seem optimistic about the company's potential for future profitability and market expansion, despite its current financial challenges. However, we would restrain from buying Carvana’s stock at current levels.

Disclaimer

The team does not guarantee the accuracy or completeness of the information provided in this newsletter. All statements reflect personal opinions based on our financial and business analysis. Any estimates, forecasts, or forward-looking statements are subject to inherent uncertainties and should be viewed as indicative only. No statement herein constitutes an offer or solicitation to buy or sell any financial instruments mentioned.

The content of our newsletter is intended for general information purposes only and does not constitute trading or investment advice. We do not offer personalized investment advice tailored to the specific needs of any recipient. The information provided should not be construed as specific advice on the merits of any investment decision. Securities trading involves significant risk, including the potential loss of capital and other losses. Investors are advised to conduct their own independent research and consult with a registered investment advisor or financial advisor before making any investment decisions.

Neither the team nor any of its affiliates shall be liable for any direct or indirect losses arising from the use of the information contained herein. Unauthorized copying, distribution, or reproduction of this newsletter or its contents is strictly prohibited.

By subscribing to or reading our newsletter, or engaging with any associated social media accounts, you agree unconditionally to accept and be bound by these terms and conditions.