Constellation Stock #7: Delta Air lines (DAL) - A Turnaround Story

Poised for strategic growth with robust fleet modernization and strong market positioning.

Intro

Today, we delve into the potential of seasonal investment opportunities, particularly in the context of the evolving airline industry. Delta Air Lines (DAL), a prominent player, is redefining its operational efficiency and financial health as travel demand cycles back to pre-pandemic levels. With strategic fleet upgrades and a focus on high-margin routes, Delta is not only navigating the seasonal peaks effectively but also showing promising improvement in its fundamental metrics, positioning it as a strong candidate for investors seeking robust returns in cyclical sectors.

Highlights

Market Position and Competition

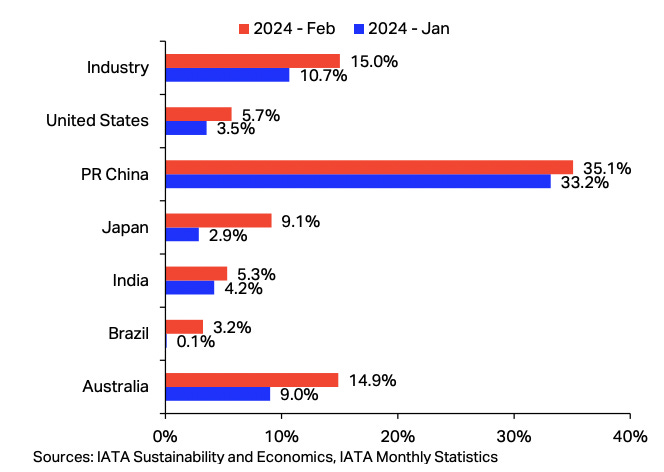

The airline industry has fully recovered from the pandemic, with total passenger traffic surpassing 2019 levels by 5.7% as of February 2024, demonstrating robust growth and resilience. Delta Air Lines, with its extensive network, benefits from this upward trend, particularly in premium travel segments.

Financial Performance

Delta reported a Q1 FY2024 operating revenue of $12.6 billion, up 6% year-over-year, with net income of $288 million, marking an 80% increase in EPS year-over-year. The airline's financial health is improving, with a focus on reducing its net debt, which was down from $20.9 billion to $20.2 billion in Q1 2024.

Management Guidance for 2024

For 2024, Delta expects to achieve a leverage ratio of 2.5 times with an operating margin between 14% to 15%. The company has adjusted its EPS forecast downward to $6-$7 but maintains a positive outlook on achieving record corporate revenues and maintaining strong consumer demand.

Challenges and Opportunities

Delta faces headwinds from higher fuel costs and increased labor expenses following wage raises. However, opportunities lie in its continued fleet modernization and strong demand for premium travel, which are expected to drive revenue growth and enhance profitability.

Strategic Developments

Delta is enhancing its fleet with 20 new Airbus A350-1000s, focusing on operational efficiency and reduced maintenance costs. The airline's strategic partnerships, particularly with American Express, continue to drive significant revenue contributions.

Contents:

Highlights

Company Description

Market Position and Competition

Financial Performance

Management Guidance for 2024

Challenges and Opportunities

Valuation Considerations

Disclaimer

Company Description

Delta Air Lines, Inc., headquartered in Atlanta, Georgia, is a premier global airline founded in 1924, known for its extensive network and commitment to innovation and customer service. Operating over 1,273 aircraft, Delta offers scheduled passenger and cargo transportation both domestically and internationally, with key hubs across the United States, including Atlanta, Minneapolis-St. Paul, Detroit, and Salt Lake City, as well as strategic coastal gateways like Boston, Los Angeles, and New York. Internationally, the airline maintains a strong presence in major global hubs such as Amsterdam, London Heathrow, Paris-Charles de Gaulle, and Tokyo.

Revenue Streams

The airline's business is divided into two main segments: Airline operations and its Refinery.

Source: GuruFocus

Market Position and Competition

The airline industry achieved a full post-pandemic recovery in total passenger traffic, surpassing the pre-pandemic levels.

Compared to 2023, where the weighted 7-day moving average was 217,453 flights, 2024's flight numbers have risen by approximately 8.8%. In comparison to 2022 (190,893 flights), there's a notable increase of about 24%, while the growth is even more pronounced relative to 2021 (164,653 flights) and 2020 (81,337 flights). This upward trajectory suggests that the global travel demand remains strong, aligning with Delta's favorable outlook on the travel environment.

Annual growth in Revenue Passenger-Kilometers (RPK) reached 21.5% y/y. Passenger load factors (PLF) improved in comparison to the previous year and settled in the vicinity of pre-pandemic levels.

RPK growth remains strong and keeps an annual double-digit pace with China’s reopening as a major driver.

In the United States market, Delta Air Lines is one of the largest domestic airlines with a market share of 17.3 percent.

Financial Performance

In the first quarter of 2024, the company reported above both EPS and revenue expectations:

Operating revenue of $12.6 billion, 6% y/y growth from the $11.8 billion in Q1 2023.

Operating income of $640 million with an operating margin of 5.1%, a 17% y/y and 11% respectively growth from 546 million with an operating margin of 4.6%.

Net income equals $288 million up 77% y/y from the $163 million.

EPS $0.45 with 80% y/y growth from the previous year's $0.25 EPS result.

Free cash flow of $1.4 billion down 26% y/y from $1.8 billion with having repaid debt from $20.9 billion in Q1 2023 to $20.2 billion in Q1 2024.

Management Guidance for 2024

The company projects a 14% to 15% operating margin, with quarterly earnings per share between $2.20 and $2.50.

Fuel costs are expected to range from $2.70 to $2.90 per gallon, a 10% increase over the previous year, including a $0.10 contribution from its refinery operations.

Non-fuel unit costs are likely to rise by approximately 2%.

Anticipated full-year free cash flow between $3 billion and $4 billion, with a leverage ratio of 2.5 times.

The airline foresees record profitability due to the ongoing benefits from its multiyear restructuring.

”Consumer demand is robust and premium trends remain strong. The outlook for corporate travel is positive. 90% of Companies in our recent survey intend to maintain or increase travel volumes in 2Q, putting us back on track to deliver record corporate revenues in the back half of this year.” - Glen W. Hauenstein, President

“...When you put this level of demand strength together with the industry's increased focus on improving financial returns, this may be the most constructive backdrop that I've seen in my airline career.” - Ed Bastian, CEO

Challenges and Opportunities

Headwinds and Risks

Fuel prices are expected to be significantly higher than the previous year, which could squeeze margins.

Increases in labor costs due to the newly announced raises, and potential inflationary pressures could negatively impact operating margins if not offset by revenue growth.

High insurance premiums, especially during periods of high interest rates.

As a highly leveraged company, Delta is sensitive to changes in interest rates. Rising rates can significantly increase the cost of servicing debt, thereby straining cash flows and reducing profitability. Plus, with high levels of debt, a significant portion of Delta's cash flow may be committed to servicing this debt. This obligation can limit the funds available for strategic investments.

Tailwinds

The recent improvement in Delta Air Lines' financial results.

Recent fleet modernization, especially considering that its fleet was previously among the oldest and perceived as less secure, with an average aircraft age of 15.3 years. This contrasts with competitors like Southwest Airlines, which has a younger average fleet age of 11.6 years.

The recovery in consumer travel behavior, particularly the resurgence in demand for premium travel experiences.

The partnership with American Express remains robust, driving significant revenue.

Valuation Considerations

Share price performance

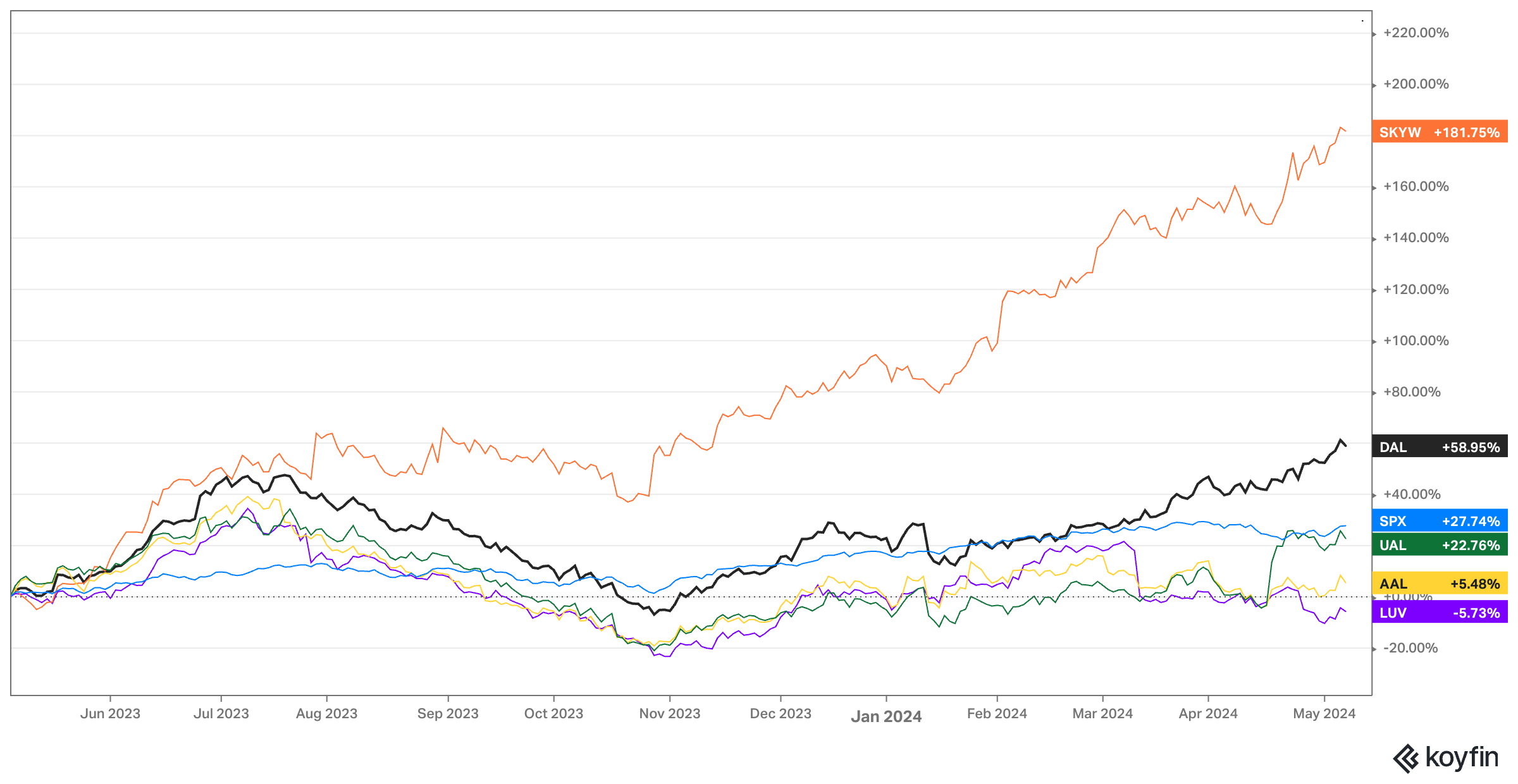

DAL has outperformed the S&P 500 index over the past year, exhibiting a robust LTM growth of 59% compared to the index's 28%.

Source: Koyfin

Share Price Target Estimate

Our goal is to estimate the share price by the end of the year. We achieve this by analyzing the company's historical P/E and P/S multiples, selecting the level most appropriate for the macroeconomic and company-specific factors expected within the year, and incorporating consensus forecasts for Revenue and EPS.

This methodology allows us to make stock price estimates in a way that is both quick and precise, which is suitable for our investment horizon.

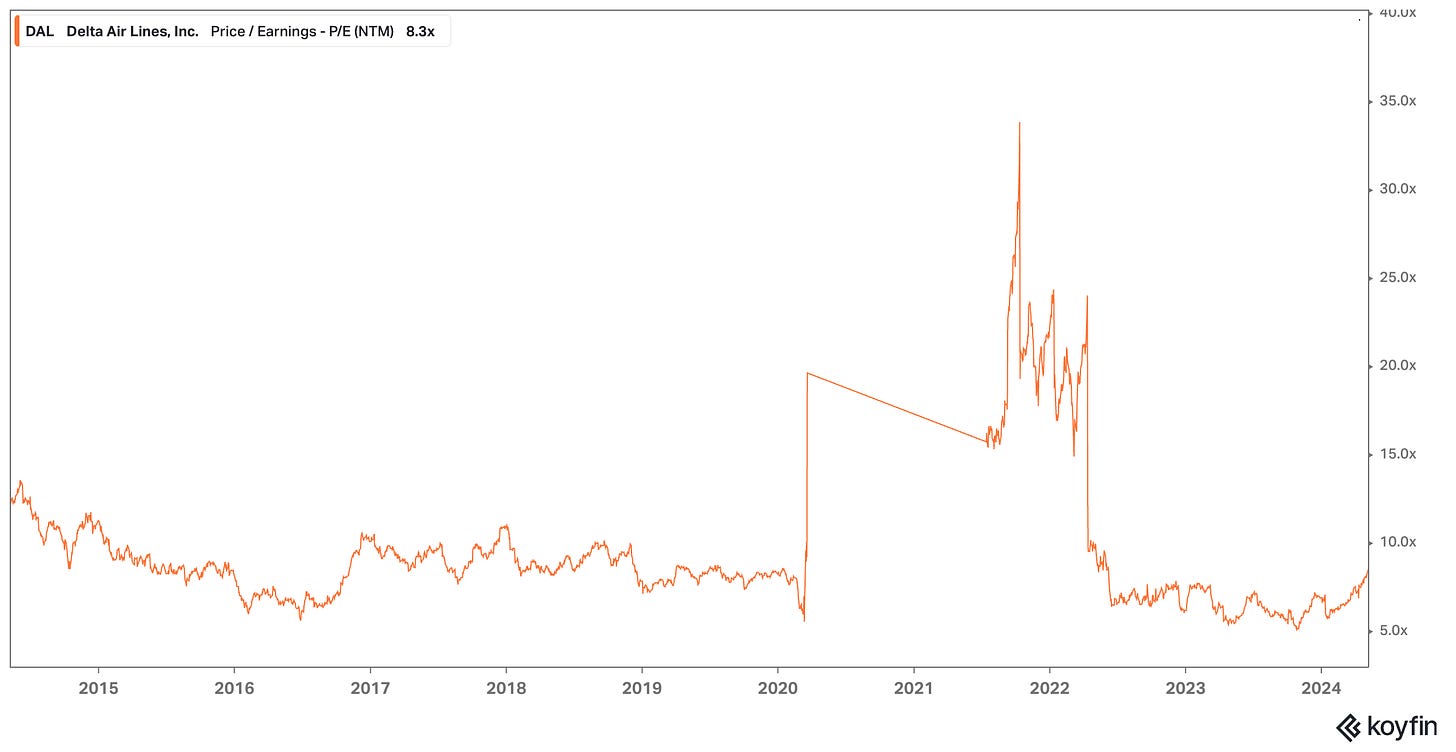

Considering the historical P/E pattern for DAL, we view a 9x multiple as the “normal” level achievable by the company in a typical economic and financial environment. However, with potential rate cuts and higher-than-expected growth, this multiple could rise to 12x.

Based on the expected non-GAAP EPS for 2024, we calculate a target price of $59.30. This represents an approximate 15% upside potential from the current price. We consider this the lower range of our estimation.

Source: Koyfin

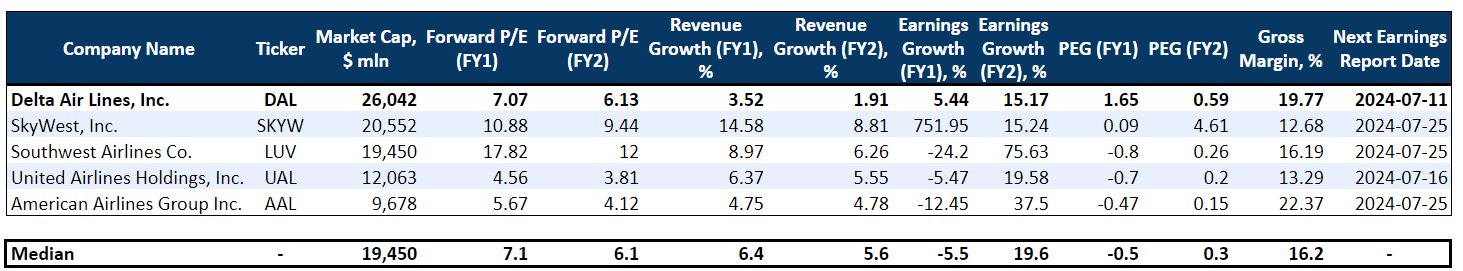

Industry Comps Breakdown

For the comparable multiples analysis, we consider the following companies as DAL's closest peers. This is based on the fact that they operate in the same market environment, and have similar business models and sizes:

Southwest Airlines Co. (LUV) - a major U.S. airline known for its low-cost, point-to-point service without assigned seats, operating a fleet of over 700 aircraft primarily within the United States.

SkyWest Inc. (SKYW) - regional flight operator in partnership with major airlines such as Delta and United, serving as a feeder network with a fleet of approximately 500 aircraft.

American Airlines Group Inc. (AAL) - one of the largest airlines in the world, offering an extensive network of domestic and international flights with a fleet of nearly 900 aircraft. It is a founding member of the Oneworld alliance.

United Airlines Holdings, Inc. (UAL) - United Airlines is a major American airline with a significant global presence, operating a fleet of about 850 aircraft. It is a founding member of the Star Alliance, the world's largest airline alliance.

As a prominent player with the “median” status in the peer group, Delta Air Lines is strategically positioned to capitalize on overall industry growth, while also having the inherent potential to return to its historical financial performance.

Disclaimer

The team does not guarantee the accuracy or completeness of the information provided in this newsletter. All statements reflect personal opinions based on our financial and business analysis. Any estimates, forecasts, or forward-looking statements are subject to inherent uncertainties and should be viewed as indicative only. No statement herein constitutes an offer or solicitation to buy or sell any financial instruments mentioned.

The content of our newsletter is intended for general information purposes only and does not constitute trading or investment advice. We do not offer personalized investment advice tailored to the specific needs of any recipient. The information provided should not be construed as specific advice on the merits of any investment decision. Securities trading involves significant risk, including the potential loss of capital and other losses. Investors are advised to conduct their own independent research and consult with a registered investment advisor or financial advisor before making any investment decisions.

Neither the team nor any of its affiliates shall be liable for any direct or indirect losses arising from the use of the information contained herein. Unauthorized copying, distribution, or reproduction of this newsletter or its contents is strictly prohibited.

By subscribing to or reading our newsletter, or engaging with any associated social media accounts, you agree unconditionally to accept and be bound by these terms and conditions.