Constellation Stock #9: Sprout Social, Inc. (SPT) - A Growth Story

With over 5 billion global users on social media, Sprout Social's platform is crucial for businesses aiming to leverage social engagement, analytics, and automation.

Intro

Today, we delve into Sprout Social, Inc. (SPT), a leading provider of social media management solutions. With over 5 billion global users on social media, Sprout Social's platform is crucial for businesses aiming to leverage social engagement, analytics, and automation. As the social media landscape evolves, Sprout Social's innovative tools and strategic market positioning, coupled with their enterprise-focused shift, make it a compelling investment opportunity.

Highlights

Market Position and Competition

Sprout Social operates in the rapidly growing social media management market, with over 5 billion users globally. The market is fragmented but increasingly consolidating, with key competitors including Hootsuite, Khoros, and Sprinklr. Sprout's all-in-one platform, scalability, ease of use, and security set it apart in this competitive landscape.

Financial Performance

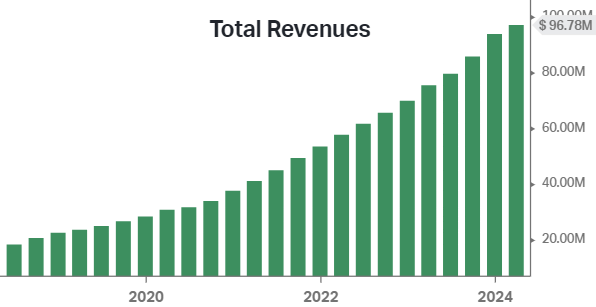

In Q1 2024, Sprout Social reported revenue of $96.8 million, up 29% year-over-year. Subscription revenue rose 28% to $95.8 million. The company achieved a non-GAAP operating income of $6.0 million, up from $1.7 million in Q1 2023, though it posted a GAAP net loss of $13.6 million due to strategic investments.

Management Guidance for 2024

Sprout Social projects Q2 2024 revenue between $98.5M and $98.6M, with non-GAAP operating income of $4.6M to $5.0M. For the full year, revenue is forecasted at $405M to $406M, and non-GAAP net income per share is expected to be $0.45 to $0.46.

Challenges and Opportunities

Challenges include strategic execution issues, a shift towards an enterprise-heavy customer base, and macroeconomic factors affecting budgets and sales cycles. Opportunities lie in pipeline growth, high-value customer acquisition, product enhancements, strategic partnerships, and financial resilience.

Strategic Developments

Sprout Social is investing in AI and social customer care solutions, enhancing its product offerings, and expanding partnerships, notably with Salesforce. The recent promotion of Ryan Barretto to CEO marks a strategic shift aimed at accelerating growth and capitalizing on the enterprise market. These developments are expected to drive sustainable revenue growth and solidify its leadership in social media management solutions.

Company Description

Sprout Social, Inc. was incorporated in 2010 and is headquartered in Chicago, Illinois. The company designs, develops, and operates a web-based social media management platform in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company provides cloud software for social messaging, data and workflows in a unified system of record, intelligence, and action. It offers integrated tools, such as social engagement/response; publishing; reporting and analytics; social listening and business intelligence; reputation management; social commerce; employee advocacy; and automation and workflows.

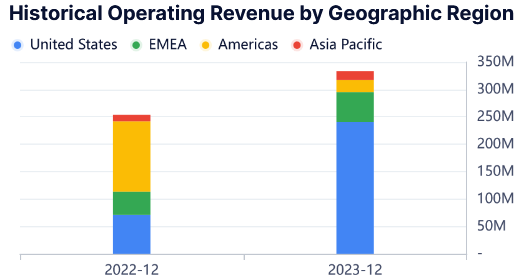

Revenue by Geographic Region

The Sprout's business historical operating revenue comes from four main regions: United States, EMEA, Americas, and Asia Pacific.

Source: GuruFocus

Market Position and Competition

Social media industry

Social media began as a way for individuals to connect and share experiences. Networks like X, Facebook, LinkedIn, and subsequent major networks allowed individuals to more easily communicate with friends, family, colleagues, and those who shared common interests. As social media grew, savvy businesses recognized its power as a channel to market to consumers at scale. A new form of advertising was born, and brands rushed to establish a presence and following on social media as a powerful new way to connect with their customers.

With more than 5 billion users and millions of businesses adopting social media, it has fundamentally changed communication and commerce, and society is just beginning to understand its implications and importance.

Market size

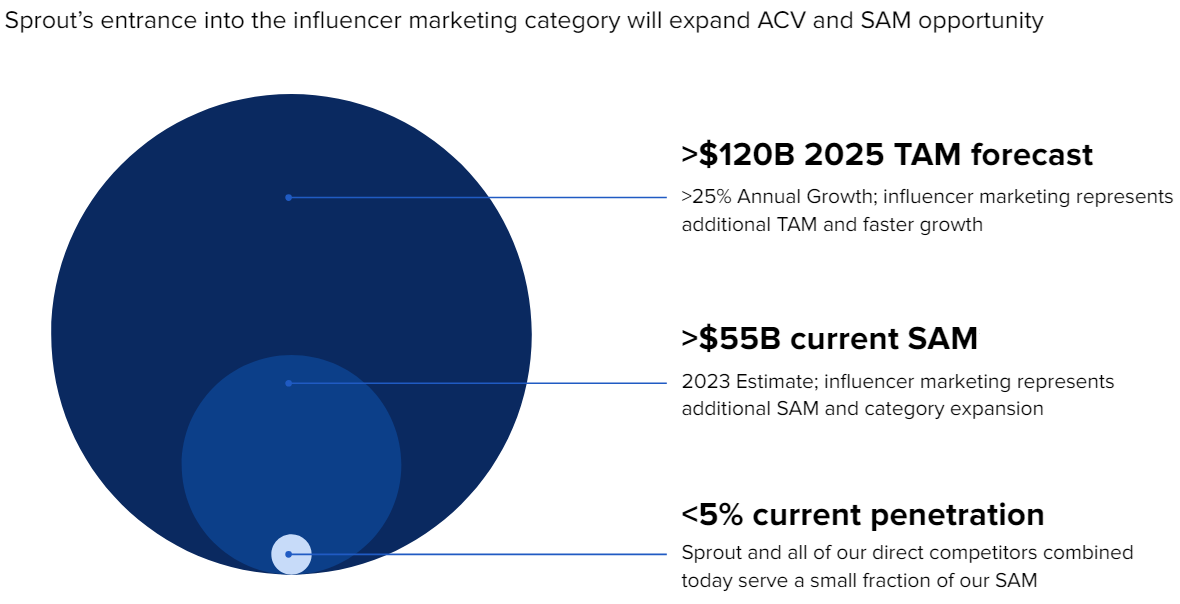

Due to social media’s rapidly growing strategic importance, it is believed that all organizations of adequate scale around the globe would benefit from using a social media management solution to engage with their consumers and drive insights from social data. The Sprout platform addresses this significant capability gap, serving what is referred to as the social media management market.

It is estimated that, based on current average customer spending levels, the annual served addressable market (SAM) for the Sprout platform in 2023 exceeded $55 billion. This SAM opportunity is projected to exceed $120 billion by 2025, indicating an annual market growth rate of greater than 25%.

Source: Official website, Q1 2024 report

Competition

There are a number of established and emerging competitors in the social media management software market. While the market remains fragmented, there has been increasing consolidation in recent years with rising barriers to entry. The competitive differentiators in this market are considered to be:

all-in-one platform;

scalability of the platform;

ease of use, security, and reliability; and

ease and cost to deploy and run the platform.

It is believed that the platform competes favorably on all of these factors.

The primary competition comes from other social media management companies such as Hootsuite, Khoros, and Sprinklr, as well as a range of independent point solutions. To remain competitive, continuous innovation and improvement of products is a priority, while simultaneously preserving a unique culture

Financial Performance

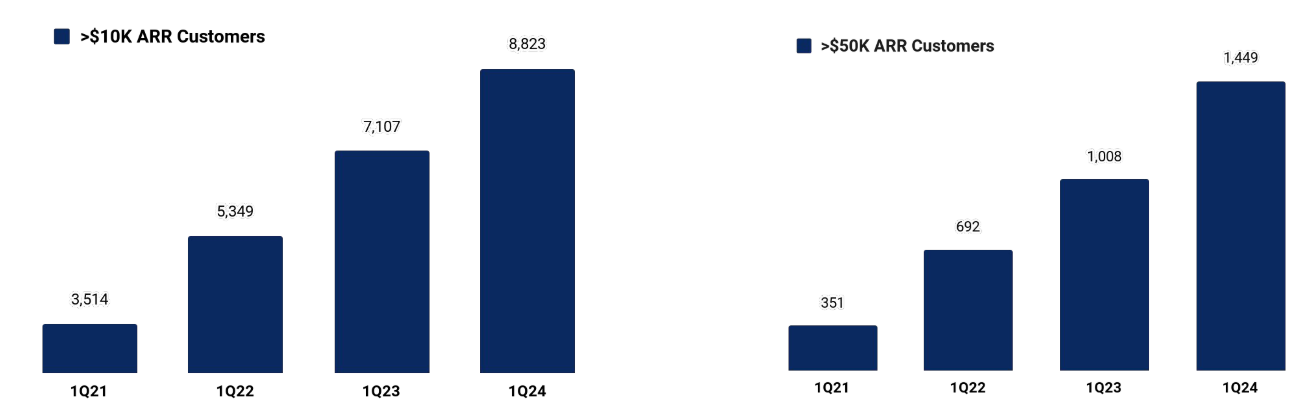

Key Metrics and Customer Growth: Sprout Social saw growth in customers contributing over $10,000 in ARR, up 24% y/y to 8,823 customers, and customers contributing over $50,000 in ARR, up 44% y/y to 1,449 customers. Despite lower-than-expected net new ARR in Q1 2024 compared to Q1 2023, the company's RPO and cRPO metrics showed significant growth:

Total remaining performance obligations (RPO): $290.0 million, up 54% y/y.

Current remaining performance obligations (cRPO): $210.6 million, up 48% y/y.

Source: Official website, Q1 2024 report

Revenue: In Q1 2024, Sprout Social reported revenue of $96.8 million, marking a 29% increase compared to Q1 2023. Subscription revenue accounted for $95.8 million, a 28% y/y rise, while services revenue was $1.0 million, up 112% y/y. Despite these gains, the company did not meet its internal revenue targets due to several strategic shifts and changing business dynamics.

Source: Koyfin

Expenses: Sprout Social's total operating expenses in Q1 2024 were $87.6 million, up from $70.3 million in Q1 2023. Key expense components included:

Research and Development (R&D): $23.8 million (19% of revenue), relatively flat y/y.

Sales and Marketing (S&M): $44.5 million (38% of revenue), down from 40% in Q1 2023.

General and Administrative (G&A): $14.5 million (15% of revenue), down from 17% y/y.

Operating Income / Loss: Sprout Social reported a non-GAAP operating income of $6.0 million (6.2% margin) in Q1 2024, up from $1.7 million in Q1 2023. GAAP operating loss was ($13.3) million, compared to ($11.9) million in the first quarter of 2023. Changed deferred commission amortization accounting from a 3 year average customer life to 5 year average life, resulting in a $4.4M reduction in Q1 sales & marketing expense.

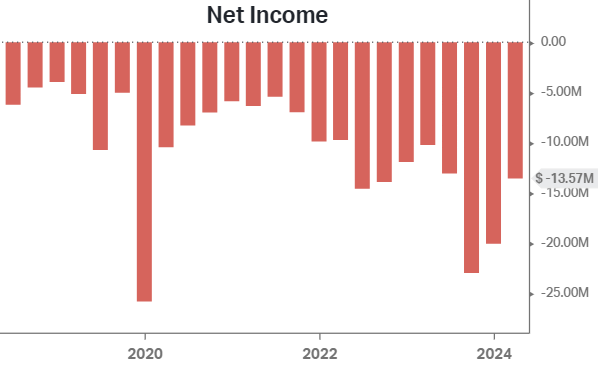

Net Income / Loss: Non-GAAP net income was $5.7 million ($0.10 per share), compared to $3.4 million ($0.06 per share) in Q1 2023. However, the GAAP net loss widened to $13.6 million (from $10.3 million y/y), reflecting increased operating expenses and strategic investments.

Source: Koyfin

Cash Flow: The company ended Q1 2024 with $95.2 million in cash, cash equivalents, and marketable securities, slightly down from $98.1 million at the end of Q4 2023. Operating cash flow was a record $11.2 million, up from $8.3 million y/y, and non-GAAP free cash flow reached $11.3 million, up from $7.9 million y/y.

Management Guidance for 2024

Revenue: For 2Q 2024, Sprout Social projects total revenue in the range of $98.5M to $98.6M, reflecting a growth rate exceeding 24%. For the full year 2024, the revenue forecast has been adjusted to a range of $405M to $406M, accounting for over 20% organic growth from Sprout's core offerings and accelerated growth in Tagger subscription revenue.

Operating Income: The company anticipates non-GAAP operating income for 2Q 2024 to fall between $4.6M and $5.0M, with a non-GAAP operating margin of approximately 4.9% at the midpoint. This guidance includes benefits from changes in deferred commission accounting, which will positively impact operating margins in future periods. For the full year 2024, non-GAAP operating income is expected to range from $28M to $29M, indicating a significant improvement of around 560 basis points in non-GAAP operating margin.

EPS: For 2Q 2024, Sprout Social estimates non-GAAP net income per share between $0.07 and $0.08, based on approximately 56.6 million weighted-average shares of common stock outstanding. For the full year 2024, non-GAAP net income per share is expected to be in the range of $0.45 to $0.46, based on roughly 57.0 million weighted-average shares outstanding.

“We are positioning ourselves to accelerate our path to $1 billion in revenue by aligning our go-to-market model around the most successful customer cohorts. Our strategic shifts are designed to capitalize on the significant opportunities in the enterprise segment.” - Ryan Barretto, CEO

“The strong pipeline growth and increasing customer retention rates are clear indicators that our strategic decisions are starting to pay off. We are confident in our ability to deliver robust financial performance in the coming quarters.” - Joseph Del Preto, CFO

Challenges and Opportunities

Headwinds and Risks

Strategic Shifts and Execution Issues: Sprout Social implemented significant strategic changes in 1Q 2024, including the creation of new vertical sales teams, adjustments in the account coverage model, and the prioritization of Tagger enablement for all customer-facing teams. These changes, although aimed at long-term growth, caused short-term execution headwinds. The disruption from these internal adjustments led to a less-than-expected net new revenue addition, setting back immediate financial targets.

Enterprise Shift Impact: The company's shift towards an enterprise-heavy customer base significantly altered the linearity of the business, affecting revenue recognition and planning. This transition brought about a longer sales cycle and higher reliance on traditional enterprise buying cycles, which were underestimated in their impact, leading to challenges in revenue forecasting and achieving set targets.

Macroeconomic Factors: The ongoing challenging macroeconomic environment further compounded the difficulties faced by Sprout Social. Increased scrutiny on budgets, involvement of more decision-makers in purchasing decisions, and elongation of sales cycles were notable macroeconomic headwinds impacting the business.

Regulatory Uncertainties: Potential regulatory changes, especially those surrounding major social media platforms like TikTok, pose a risk. Any significant regulatory action against such platforms could disrupt Sprout Social’s customer engagement and marketing strategies, requiring quick adaptation to new social media dynamics.

Tailwinds

Pipeline Growth and Customer Retention: Sprout Social saw a 37% y/y increase in total pipeline, indicating strong future sales potential. Additionally, gross retention overperformed against planned targets, suggesting a stable and satisfied customer base, particularly among enterprise clients. This retention strength is a positive signal for long-term customer loyalty and recurring revenue.

Upmarket Focus and High-Value Customer Acquisition: The strategic shift to focus on mid-market and enterprise customers is showing promise. The company reported a 44% y/y growth in the number of customers contributing over $50,000 in ARR, and a 41% y/y increase in ACV. This upmarket focus is expected to drive more significant, sustainable revenue growth through larger, more stable customer contracts.

Product Enhancements and Strategic Investments: Investments in AI and social customer care solutions are beginning to yield strong returns. Enhancements to the product offering, such as the integration of Tagger for influencer marketing, have been well-received, driving both new business and upsell opportunities. The company's innovation in these areas is positioning it as a leader in comprehensive social media management solutions.

Partnerships and Ecosystem Expansion: The partnership with Salesforce and other key players continues to offer growth opportunities. Although the contribution from Salesforce accounted for a smaller portion of new business, the potential for future growth remains significant. Sprout Social’s ability to integrate and leverage these partnerships will be crucial in capturing a larger share of the market.

Financial Resilience and Cash Flow: Despite the short-term challenges, Sprout Social reported strong non-GAAP financial metrics, including a non-GAAP operating income of $6.0 million and a record non-GAAP free cash flow of $11.3 million in 1Q 2024. This financial resilience, supported by effective cost management and strategic investments, positions the company well to navigate current headwinds and capitalize on future opportunities.

Valuation Considerations

Share price performance

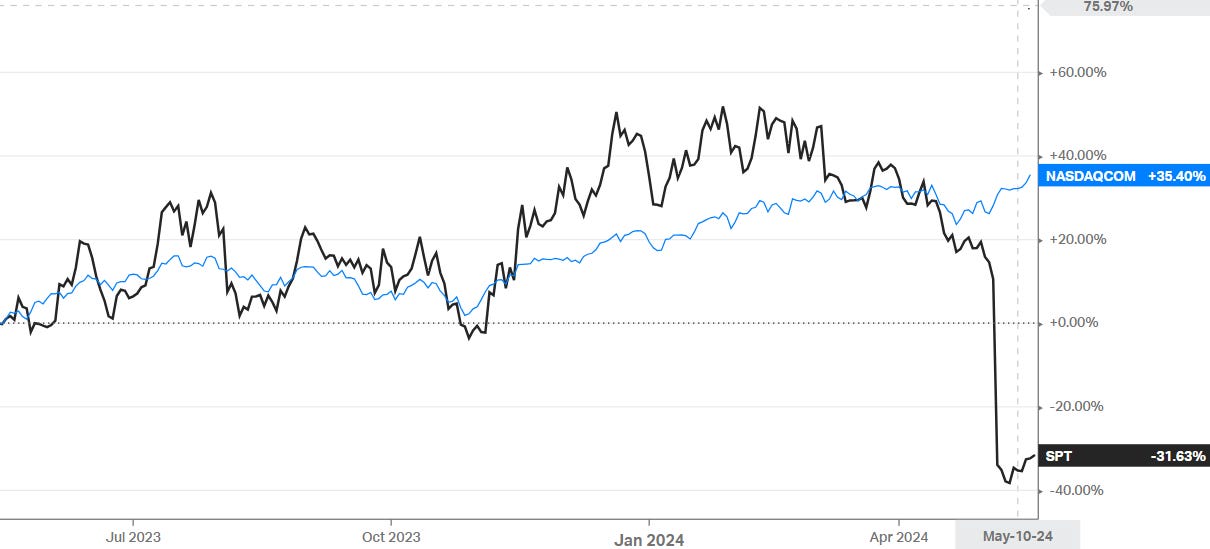

Over the past 12 months, the company's price has underperformed the NASDAQ, in particular as a result of a 30% price decrease after the company reported Q1 revenue that missed analysts' expectations.

Source: Koyfin

Share Price Target Estimate

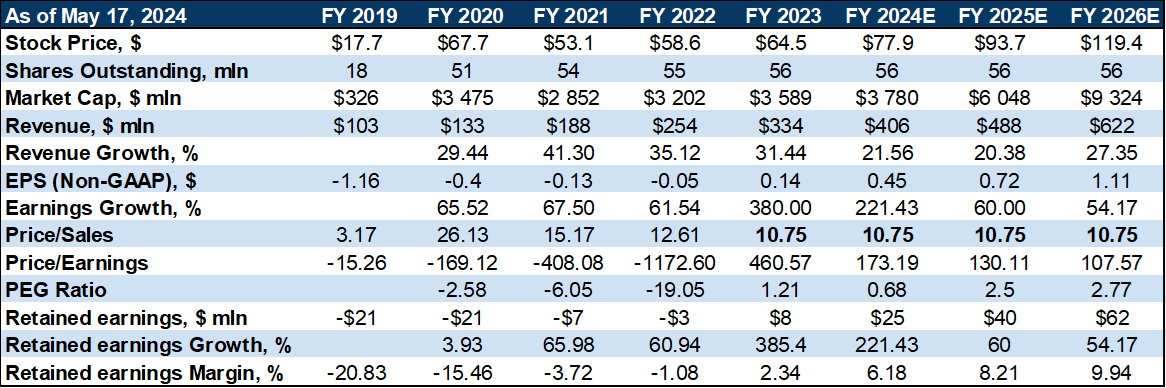

Our goal is to estimate the share price by the end of the year. We achieve this by analyzing the company's historical P/E and P/S multiples, selecting the level most appropriate for the macroeconomic and company-specific factors expected within the year, and incorporating consensus forecasts for Revenue and EPS.

This methodology allows us to make stock price estimates in a way that is both quick and precise, which is suitable for our investment horizon.

Source: Own Research

If the P/S multiplier remains at the level of FY 2024 until FY 2026, then by the end of FY 2025, due to revenue increase, the share price will also increase by 45% (compared to the price at the end of FY 2023) and amount to $93.7.

Industry Comps Breakdown

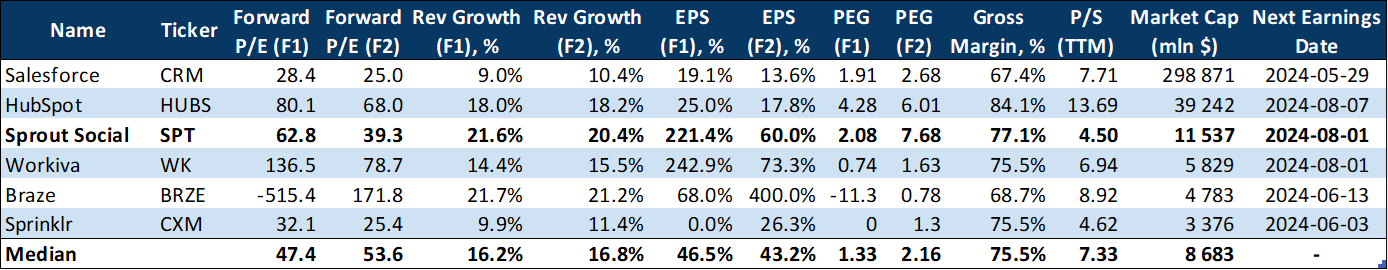

Sprout's multipliers, like some of its competitors, are significantly high due to the projected significant revenue and profit growth rates.

Source: Own Research

For the comparable multiples analysis, we consider the following companies as SPT's closest peers.

Salesforce (CRM) Salesforce is a global leader in CRM software, offering applications for marketing, sales, service, and more, primarily targeting enterprise clients.

HubSpot (HUBS) HubSpot provides marketing, sales, customer service, and CRM software aimed at small to mid-sized businesses, known for its user-friendly interface and inbound marketing focus.

Workiva (WK) Workiva offers cloud-based solutions for reporting and compliance, connecting data, documents, and teams to streamline business processes and enhance transparency.

Braze (BRZE) Braze is a customer engagement platform that helps brands build personalized, cross-channel experiences through real-time interactions across various digital channels.

Sprinklr (CXM) Sprinklr provides a unified platform for customer experience management, integrating social media, messaging, and other digital channels to deliver consistent and engaging customer experiences.

Disclaimer

The content of this report is not trading or investment advice and we do not provide any personal investment advice tailored to the needs of any recipient. The information provided should not be considered as specific advice on the merits of any investment decision. Securities trading involves risk, and you might lose your capital and/or incur other damages. Investors should do their own research and consult their registered investment advisor or financial advisor before making any investment decision.

Neither the team nor any of its affiliates accept any liability whatsoever for any direct or indirect loss however arising from any use of the information contained herein. Any unauthorized copy of this research or its contents is illegal.